Buying a car is exciting. But it can be confusing too. Especially when it comes to paying for it. Many people choose financing. This means borrowing money to buy the car. Let’s explore how to finance a car.

Understanding Car Financing

Financing is a way to pay for a car. You borrow money from a bank or lender. Then, you pay it back over time. Usually monthly. This is called a loan. Loans have interest. Interest is extra money you pay for borrowing.

Types of Car Loans

There are different types of car loans. Here are some common ones:

- Bank Loans: Get a loan from a bank. You pay it back monthly.

- Dealership Financing: Get a loan from the car dealer. They offer loans directly.

- Online Lenders: Apply for loans online. It’s fast and easy.

Steps to Finance a Car

Financing a car involves several steps. Let’s break it down.

Step 1: Decide Your Budget

Think about how much you can spend. This includes monthly payments. Also, consider your savings. Do not forget other costs. Like insurance and maintenance.

Step 2: Check Your Credit Score

Credit score matters. It shows how well you pay back money. A good score means better loan rates. Check your score before applying for loans.

Step 3: Research Loan Options

Look at different loan options. Compare interest rates and terms. Choose the best one for you. This step is important.

Step 4: Apply For A Loan

Once you choose a loan, apply for it. You need to fill out forms. Provide some information. Like your income and job details.

Step 5: Get Pre-approved

Pre-approval is when a lender agrees to lend you money. It shows sellers you are serious. Helps you know how much you can spend.

Step 6: Choose Your Car

Pick the car you want. Make sure it fits your budget. Consider features and size. Think about fuel costs and more.

Step 7: Finalize The Deal

Once you choose a car, finalize the deal. Sign loan papers. Pay any upfront fees. Drive home in your new car.

Tips for Successful Car Financing

Financing a car can be easy. Here are some tips to help you:

- Shop Around: Don’t choose the first loan offer. Compare different lenders.

- Negotiate: Talk to dealers. Negotiate price and loan terms.

- Read the Fine Print: Understand all loan terms. Look for hidden fees.

- Keep Payments Affordable: Choose a loan with affordable monthly payments.

- Consider a Co-Signer: If your credit score is low, a co-signer can help.

Benefits of Financing a Car

Financing a car has benefits. It helps you buy a car when you can’t pay all at once. Here are some advantages:

| Benefit | Explanation |

|---|---|

| Flexible Payments | Pay monthly instead of all at once. It’s easier on your budget. |

| Drive Sooner | Get the car quickly. No need to save for years. |

| Build Credit | Paying on time improves your credit score. |

Frequently Asked Questions

What Are The Benefits Of Financing A Car?

Financing a car helps spread payments over time. This makes it affordable. You can drive your car while paying.

How Does Car Financing Work?

You borrow money from a lender. Pay back in monthly installments. Interest is included in payments.

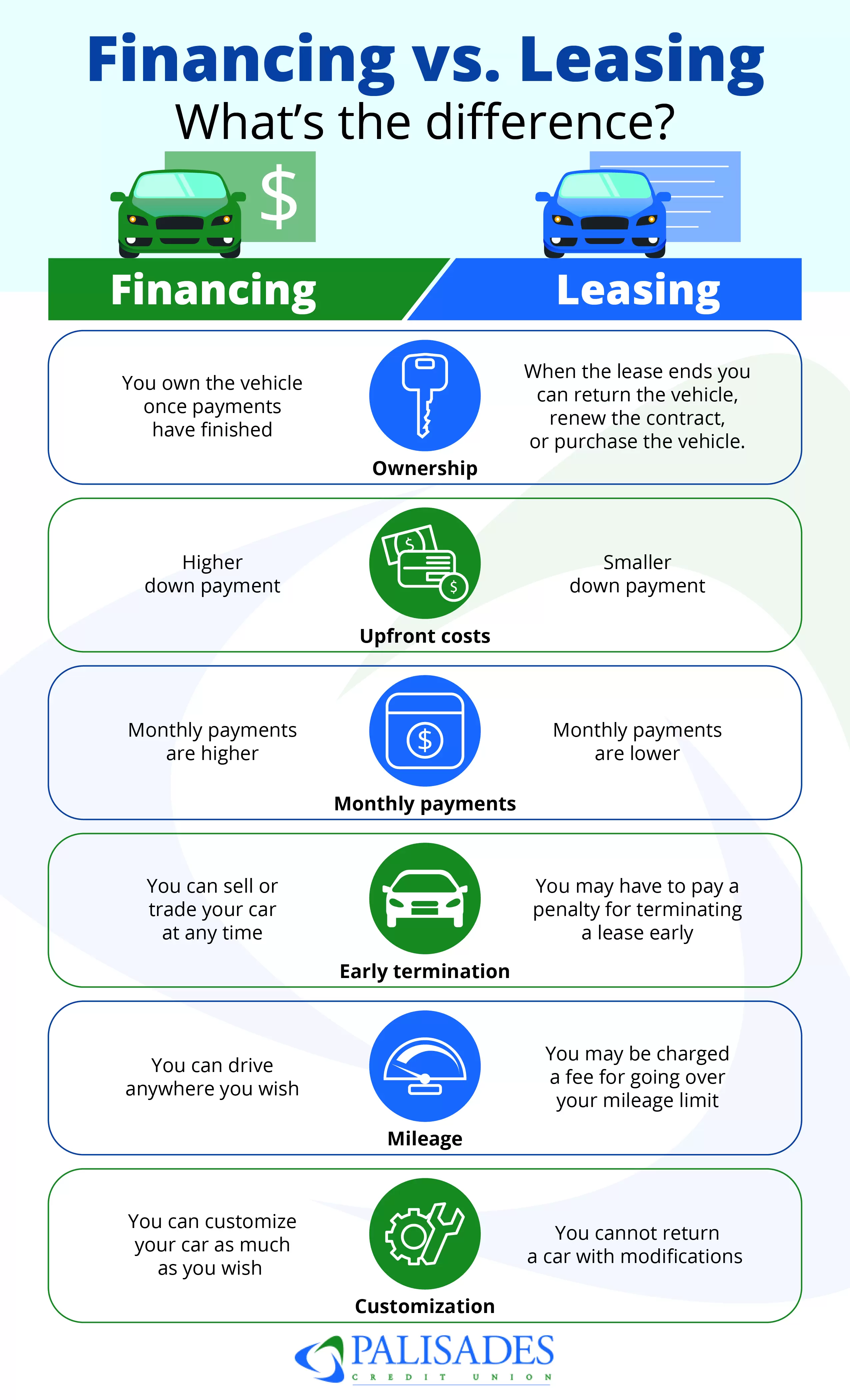

Is It Better To Lease Or Finance A Car?

Leasing offers lower monthly payments. Financing lets you own the car. Consider your needs and budget.

What Credit Score Is Needed For Car Financing?

Typically, a score of 600 or above is needed. Higher scores get better rates. Always check with your lender.

Conclusion

Financing a car is a smart choice for many. It allows you to drive the car you want. Even if you can’t pay all at once. Follow these steps and tips. They will make the process easier. Remember, a good plan leads to successful financing.

Now you know how to finance a car. It’s time to start your journey. Happy car buying!

Read More:

- Best Car Insurance Companies: Top Picks for 2025

- Subprime Auto Financing: Unlock Your Car Dreams

- Compare Auto Insurance Rates: Save Big on Premiums

- Car Loans for Bad Credit: Unlock Your Dream Ride

- Cheap Auto Insurance: Unlock Savings Today!

- Auto Loan Refinance: Unlock Savings Today!

- Best Extended Warranty: Ultimate Protection Guide

- Auto Repair near Me: Find Top Rated Services Instantly