Buying a car is exciting. Cars help us travel far. But cars cost a lot. Many people need help to buy a car. They need loans. This is where auto loan pre-qualification comes in.

What is Auto Loan Pre-Qualification?

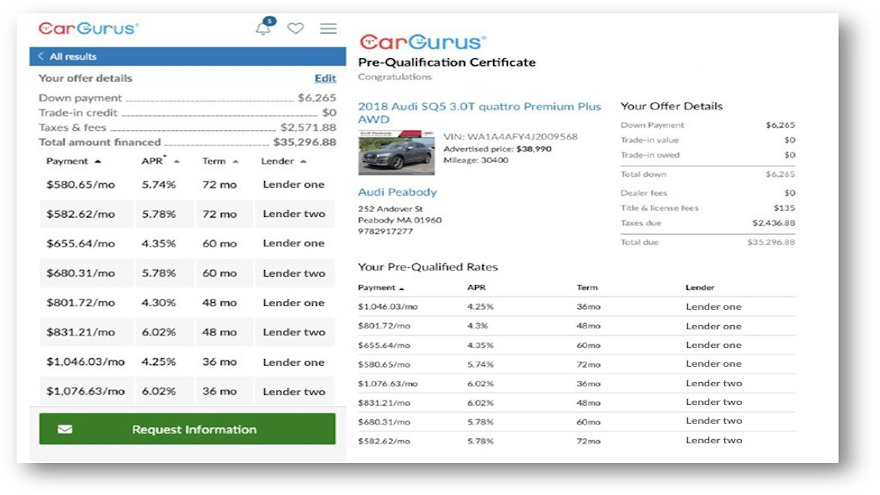

Pre-qualification is a simple process. It tells you if you might get a loan. You learn how much you can borrow. You also learn about interest rates. It is not a promise. But it helps you plan.

Why is Pre-Qualification Important?

Pre-qualification has many benefits. It saves time. You know your budget. You can shop confidently. Sellers take you seriously. You feel less stress.

Benefits Of Pre-qualification

- Know your budget.

- Shop with confidence.

- Reduce stress.

- Get better deals.

How Does Pre-Qualification Work?

Pre-qualification is easy. You contact a lender. You share some information. The lender checks your info. They give you feedback. This is quick.

Steps To Pre-qualify

- Find a lender.

- Provide information.

- Wait for feedback.

- Receive pre-qualification.

Information Needed for Pre-Qualification

Lenders need basic details. They ask about your income. They ask about your debts. They ask for your credit score. They use this to help you.

| Information Needed | Why It Matters |

|---|---|

| Income | Shows how much you earn. |

| Debts | Shows what you owe. |

| Credit Score | Shows your credit health. |

Tips for Smooth Pre-Qualification

Pre-qualification can be smooth. Follow these tips. They help you succeed.

Keep Your Information Ready

Prepare your documents. Have your income proof. Know your debts. Check your credit score. This saves time.

Choose A Trusted Lender

Find a good lender. Read reviews. Ask friends for advice. Trusted lenders are helpful.

Understand Your Needs

Know what you want. Think about your budget. Decide on car type. Clear goals help.

Difference Between Pre-Qualification and Pre-Approval

People mix these terms. They are not the same. Pre-qualification is a first step. It is less detailed. Pre-approval is more serious. It requires more checks.

Pre-qualification Vs. Pre-approval

| Feature | Pre-Qualification | Pre-Approval |

|---|---|---|

| Detail Level | Basic | Detailed |

| Commitment | No commitment | Conditional offer |

Common Mistakes in Pre-Qualification

Some people make mistakes. Avoid these. They help you do better.

Not Checking Credit Score

Credit score matters. Check it before you start. It helps you plan.

Ignoring Other Debts

Debts affect loans. Tell lenders about them. This helps them decide.

Frequently Asked Questions

People have questions about pre-qualification. Here are some answers.

Does Pre-qualification Affect Credit Score?

No. It is a soft check. It does not affect your score.

How Long Does Pre-qualification Take?

It is quick. Usually, it takes a few days.

Can I Change Lenders Later?

Yes. You can switch lenders. Pre-qualification does not bind you.

Frequently Asked Questions

What Is Auto Loan Pre-qualification?

Auto loan pre-qualification is an initial assessment. It estimates your chances for loan approval.

How Does Pre-qualification Affect Credit Score?

Pre-qualification typically performs a soft credit check. It doesn’t affect your credit score.

Can I Negotiate Better Terms With Pre-qualification?

Yes, pre-qualification can help. It shows lenders your creditworthiness and can improve negotiation.

Is Pre-qualification A Guarantee For Loan Approval?

No, it isn’t a guarantee. It’s an estimate based on initial information.

Conclusion

Auto loan pre-qualification is useful. It helps you plan. It makes buying a car easier. Follow the tips. Enjoy your car shopping.

Read More:

- Best Car Insurance Companies: Top Picks for 2025

- Subprime Auto Financing: Unlock Your Car Dreams

- Compare Auto Insurance Rates: Save Big on Premiums

- Car Loans for Bad Credit: Unlock Your Dream Ride

- Cheap Auto Insurance: Unlock Savings Today!

- Auto Loan Refinance: Unlock Savings Today!

- Best Extended Warranty: Ultimate Protection Guide

- Auto Repair near Me: Find Top Rated Services Instantly