What is SR-22 Insurance?

SR-22 is not insurance. It is a form. This form shows you have insurance. Some people need it. Not everyone does.

The SR-22 form is for drivers. These drivers have had problems. Maybe they had an accident. Maybe they got a ticket.

Why Do You Need SR-22 Insurance?

Some drivers need SR-22 insurance. This is because of past actions. These actions might include:

- Driving without insurance

- Getting too many tickets

- Being in serious accidents

- Driving under the influence

If a court asks for SR-22, you must get it. Without it, you cannot drive legally.

How to Get SR-22 Insurance Quotes

Getting SR-22 insurance quotes is important. Start by contacting insurance companies. Tell them you need SR-22.

Here is a simple way to get quotes:

- Call or visit insurance companies.

- Ask for SR-22 quotes.

- Compare the quotes.

- Choose the best one for you.

Remember, not all companies offer SR-22. So, you might have to ask several.

Factors Affecting SR-22 Insurance Quotes

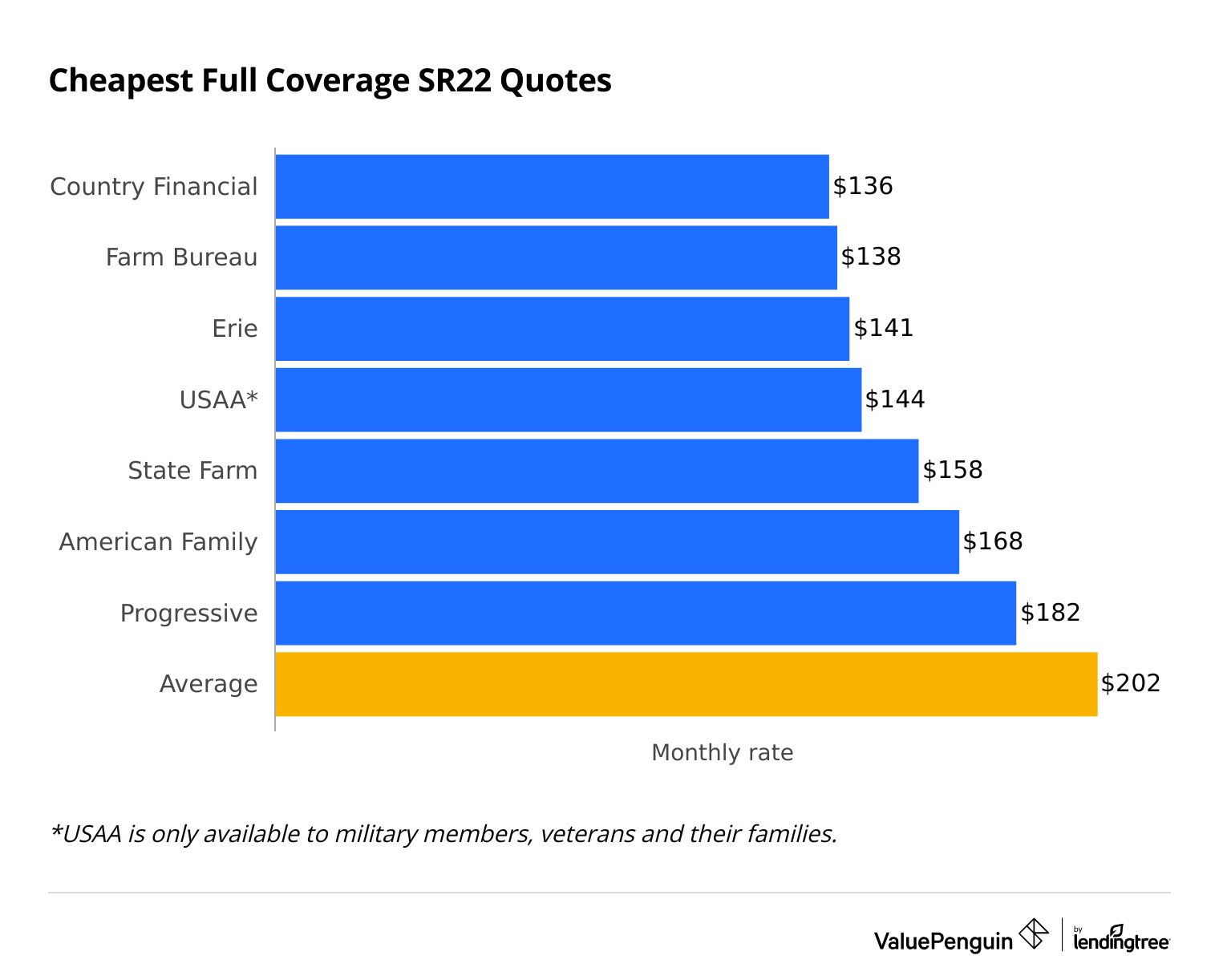

Many factors affect SR-22 quotes. Here are some key factors:

| Factor | Explanation |

|---|---|

| Driving Record | Good records mean lower quotes. Bad records mean higher quotes. |

| Age | Younger drivers often pay more. |

| Location | City drivers may pay more than country drivers. |

| Car Type | Expensive cars can lead to higher quotes. |

Each factor plays a role in the cost. Knowing them helps you understand your quote.

How to Lower Your SR-22 Insurance Quote

Want to lower your SR-22 quote? Here are some tips:

- Keep a clean driving record.

- Take a defensive driving course.

- Choose a safe, less expensive car.

- Ask about discounts.

These steps can help reduce your insurance cost. Always ask your agent for more ways.

What Happens If You Don’t Get SR-22?

If you need SR-22 and don’t get it, you face problems. Here is what could happen:

- Lose your driver’s license

- Get more fines

- Face legal trouble

It’s important to have SR-22 if required. It keeps you on the road legally.

How Long Do You Need SR-22 Insurance?

SR-22 is not forever. Most need it for three years. Some might need it longer.

Your situation decides how long you need it. Always check with your insurance company.

Finding the Right Insurance Company

Not all companies offer SR-22. You need to find the right one. Look for companies that specialize in SR-22.

Here are some tips:

- Read reviews online.

- Ask friends for recommendations.

- Check the company’s history.

Finding the right company ensures you get the best service and price.

Frequently Asked Questions

What Is Sr-22 Insurance?

SR-22 insurance is a certificate proving you have minimum required auto insurance.

Why Do I Need An Sr-22?

You need an SR-22 if a court or state law mandates it for driving violations.

How Long Must I Have Sr-22 Insurance?

Typically, you need SR-22 insurance for three years, but this varies by state.

Can I Get Sr-22 Insurance Without A Car?

Yes, non-owner SR-22 insurance is available for those without a vehicle.

Conclusion

SR-22 insurance is important for some drivers. It shows you have coverage. If you need SR-22, act quickly. Get quotes and find the right company. Remember, keeping a clean record helps.

Driving legally is important. Follow the rules and drive safely.

Read More:

- Best Car Insurance Companies: Top Picks for 2025

- Subprime Auto Financing: Unlock Your Car Dreams

- Compare Auto Insurance Rates: Save Big on Premiums

- Car Loans for Bad Credit: Unlock Your Dream Ride

- Cheap Auto Insurance: Unlock Savings Today!

- Auto Loan Refinance: Unlock Savings Today!

- Best Extended Warranty: Ultimate Protection Guide

- Auto Repair near Me: Find Top Rated Services Instantly