Do you have a car loan? You might want to save money. Refinancing your auto loan can help.

What Is Auto Loan Refinance?

Auto loan refinance means getting a new loan. This new loan pays off your old loan. You still have the car. You just change the loan terms.

Why Refinance?

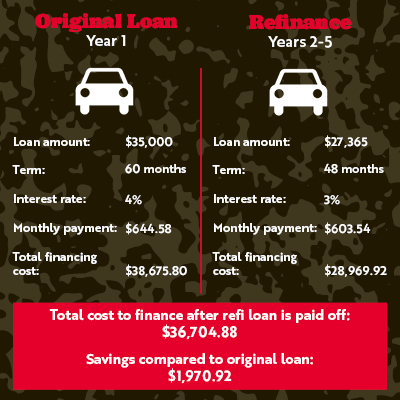

Refinancing can lower your monthly payments. It can also reduce the interest rate. This means you pay less money over time.

Benefits of Refinancing

- Lower monthly payment

- Reduce interest rate

- Save money over time

- Better loan terms

These benefits can make your life easier. You keep more money in your pocket. You have less stress about payments.

Who Should Consider Refinancing?

Not everyone needs to refinance. But some people can benefit a lot.

Check Your Credit Score

If your credit score has improved, refinancing might help. Better credit can mean better loan terms.

Interest Rates Have Dropped

If interest rates are lower now, refinancing can save you money. Check the current rates. Compare them to your loan rate.

Struggling With Payments

Are monthly payments too high? Refinancing can lower them. This can make your budget easier to manage.

Steps to Refinance Your Auto Loan

Refinancing your auto loan can be simple. Follow these steps.

1. Review Your Current Loan

Check your loan details. Look at the interest rate. Look at the monthly payment. Understand what you have now.

2. Check Your Credit Score

Check your credit score. A higher score can get better rates. You can check online for free.

3. Compare Lenders

Look at different banks and lenders. Compare their loan offers. Look at interest rates and terms. Choose the best option for you.

4. Apply For Refinance

Once you choose a lender, apply for the loan. Provide the necessary documents. The lender will review your application.

5. Pay Off The Old Loan

If approved, the new lender will pay off your old loan. You start paying the new lender. Your loan terms change.

6. Enjoy Your Savings

With the new loan, enjoy the savings. Lower payments mean more money for you. Celebrate your smart choice.

Things to Consider

Refinancing is not always best. Think about these points.

Fees And Costs

Some lenders have fees. Make sure you know all costs. Calculate if refinancing saves you money after fees.

Loan Term Changes

Refinancing can change your loan term. A longer term means more interest. Calculate total payments over the loan’s life.

Impact On Credit Score

Applying for loans can impact your credit score. Be sure this impact is worth the savings.

Frequently Asked Questions

What Is Auto Loan Refinancing?

Auto loan refinancing means replacing your current car loan with a new one. It often has better terms.

How Does Refinancing An Auto Loan Work?

You apply for a new loan to pay off your old one. Then, you start paying the new lender.

Why Should I Consider Refinancing My Auto Loan?

You might get a lower interest rate. This could reduce your monthly payments.

Can I Refinance My Car Loan With Bad Credit?

Yes, but it might be harder. Interest rates could be higher.

Conclusion

Auto loan refinance can be a smart choice. It can save you money. It can lower monthly payments. Review your situation. Follow the steps. Make an informed decision.

Refinancing can make life easier. Understand the benefits. Know the steps. Take control of your finances.

Read More:

- Best Car Insurance Companies: Top Picks for 2025

- Subprime Auto Financing: Unlock Your Car Dreams

- Compare Auto Insurance Rates: Save Big on Premiums

- Car Loans for Bad Credit: Unlock Your Dream Ride

- Cheap Auto Insurance: Unlock Savings Today!

- Best Extended Warranty: Ultimate Protection Guide

- Auto Repair near Me: Find Top Rated Services Instantly

- Car Financing at Dealership: Unlock Best Deals