Car loans can be tricky. Many people find it hard to understand. But there is a tool that can help. It is called a car loan refinance calculator. This tool helps you figure out your loan options. It can save you money.

What is a Car Loan Refinance Calculator?

A car loan refinance calculator is a simple tool. It helps you see how much money you can save. You just need to enter some numbers. Then, the calculator does the math for you. Easy and helpful!

Why Use A Car Loan Refinance Calculator?

There are many reasons to use this calculator. Here are a few:

- It helps you understand your loan better.

- It shows you how much you can save.

- It helps you plan your budget.

How Does The Calculator Work?

It is simple to use. You need some information first. Here is what you need:

| Information Needed | Explanation |

|---|---|

| Current Loan Amount | How much you owe right now. |

| Interest Rate | The percentage you pay extra. |

| Loan Term | How long you have to pay. |

| New Interest Rate | The new percentage after refinance. |

| New Loan Term | The new time period to pay. |

After you enter this information, the calculator shows results. You can see your new payment. You can see how much you save. It is very useful.

Benefits of Refinancing Your Car Loan

Refinancing means getting a new loan. The new loan pays off the old loan. Here are benefits:

- Lower Monthly Payments: You pay less each month.

- Lower Interest Rate: You pay less over time.

- Better Terms: You might get better loan conditions.

When To Consider Refinancing

Not everyone needs to refinance. Here are times to think about it:

- You have a high interest rate.

- You need to lower monthly payments.

- Your credit score has improved.

If any of these apply, consider refinancing. It might be a smart move.

Steps to Refinance Your Car Loan

Refinancing can be easy. Here are steps to follow:

- Check your current loan details.

- Find a lender with better rates.

- Use the refinance calculator.

- Compare your options.

- Apply for the new loan.

- Pay off the old loan.

These steps are simple. They help you get a better loan.

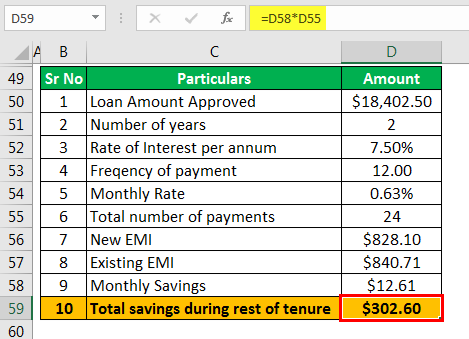

Example Of Using A Car Loan Refinance Calculator

Let’s look at an example. Imagine you have a loan. Your current loan amount is $10,000. Your interest rate is 5%. Your loan term is 5 years.

You find a new loan. The new interest rate is 3%. The new term is 4 years.

Using the calculator, you enter these numbers. It shows your new monthly payment. It shows your total savings. This can be very helpful.

Frequently Asked Questions

What Is A Car Loan Refinance Calculator?

A tool to estimate savings by refinancing your car loan. Input loan details. Get quick results.

How Does A Refinance Calculator Work?

It calculates potential savings. Compares current loan with new terms. Shows monthly payments and total interest saved.

Why Use A Car Loan Refinance Calculator?

To see potential savings. Understand new payment terms. Make informed refinancing decisions.

Can I Save Money With Refinancing?

Yes, potentially. Lower interest rates can reduce monthly payments and total interest.

Conclusion

A car loan refinance calculator is a great tool. It helps you see your options. It can save you money. It makes understanding loans easier.

If you have a car loan, consider using a calculator. It might help you find a better deal. Remember, always check your options. Make smart choices.

Refinancing can be a good idea. But it is important to understand it first. The calculator helps with that. Use it to make the best decision for you.

Read More:

- Best Car Insurance Companies: Top Picks for 2025

- Subprime Auto Financing: Unlock Your Car Dreams

- Compare Auto Insurance Rates: Save Big on Premiums

- Car Loans for Bad Credit: Unlock Your Dream Ride

- Cheap Auto Insurance: Unlock Savings Today!

- Auto Loan Refinance: Unlock Savings Today!

- Best Extended Warranty: Ultimate Protection Guide

- Auto Repair near Me: Find Top Rated Services Instantly