Buying a car is exciting. But it can be a bit hard, too. A car loan pre-approval can help you. It makes buying a car easier.

What is Car Loan Pre Approval?

Car loan pre-approval is a process. The bank checks if you can get a loan. They look at your money and job. If they say yes, you get a pre-approval.

This pre-approval means you can borrow a certain amount. It is like a promise. You know how much you can spend on a car.

:max_bytes(150000):strip_icc()/approved-car-loan-application-98570101-5b800241c9e77c0050572c53.jpg)

Why is Car Loan Pre Approval Important?

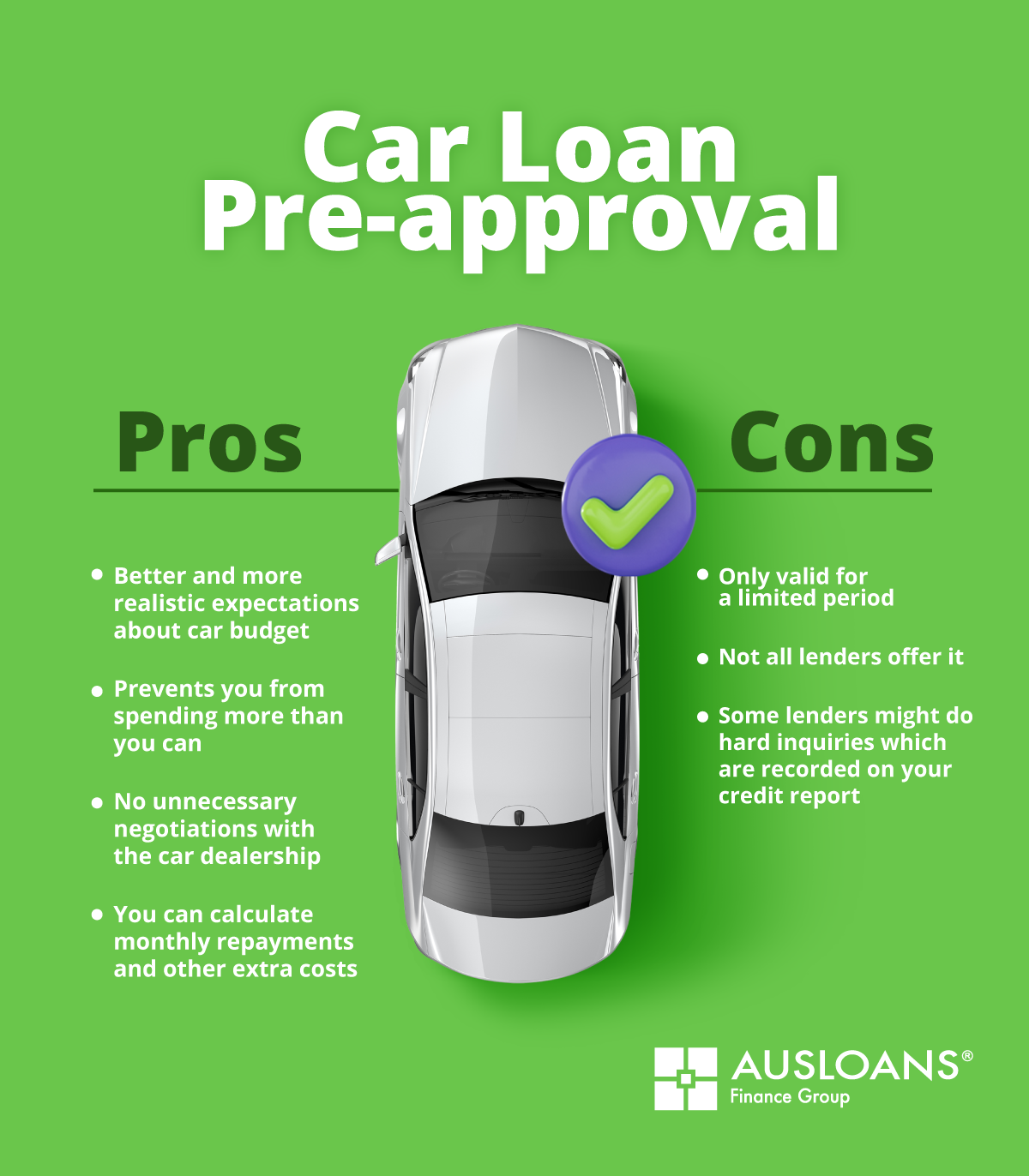

Pre-approval is helpful. It has many benefits:

- Budgeting: You know your budget. You won’t spend too much.

- Confidence: You can shop with confidence. You know how much you can borrow.

- Negotiation: Sellers take you seriously. You have a pre-approval.

- Time-saving: You save time. You skip some steps at the dealership.

How to Get Pre Approved for a Car Loan?

Getting pre-approved is not hard. Follow these steps:

1. Check Your Credit Score

Your credit score is important. It tells banks if you are good with money. A high score is good. It helps you get a loan.

2. Gather Your Financial Information

Get your financial details ready. This includes your income and bills. Banks need this to check if you can pay back the loan.

3. Choose A Lender

Pick a bank or credit union. They will help with your pre-approval. Compare different lenders. Look at their loan rates.

4. Apply For Pre Approval

Fill out a form for pre-approval. You can do this online or in person. Provide all the needed information.

5. Wait For The Lender’s Decision

The bank will look at your details. They will decide if you can get a loan. This can take a few days.

If approved, you get a pre-approval letter. This letter shows how much money you can borrow.

What to Do After Getting Pre Approved?

Now you have your pre-approval. What next?

1. Start Shopping For Your Car

Look for cars within your budget. Remember your pre-approval amount. Stick to it.

2. Test Drive The Car

See how the car feels. Make sure it is comfortable for you.

3. Negotiate The Price

Talk to the seller about the price. Use your pre-approval as a tool. Sellers know you are serious.

4. Finalize The Loan

Once you pick a car, finalize the loan. Give the bank your car details. They will set up the loan.

Things to Remember

- Pre-approval is not a final approval. It can change.

- Interest rates can vary. Check with your bank.

- Pre-approvals last for a short time. Usually 30 to 60 days.

Frequently Asked Questions

What Is Car Loan Pre-approval?

Car loan pre-approval estimates your borrowing power. It shows how much money you can borrow for a car.

How Does Pre-approval Affect Car Buying?

Pre-approval simplifies car buying. It shows how much you can afford, making negotiations easier with sellers.

Can Pre-approval Speed Up The Loan Process?

Yes, it speeds up the process. Lenders already have your information, making final approval quicker and smoother.

Is Pre-approval For Car Loans Necessary?

Not necessary, but beneficial. It helps you understand your budget and gives you confidence while shopping.

Conclusion

Car loan pre-approval can make buying a car easier. It helps you know your budget. It gives you confidence when shopping. Follow the steps to get pre-approved. Then enjoy your car shopping journey!

Remember, always drive safely and take care of your car. Happy driving!

Read More:

- Best Car Insurance Companies: Top Picks for 2025

- Subprime Auto Financing: Unlock Your Car Dreams

- Compare Auto Insurance Rates: Save Big on Premiums

- Car Loans for Bad Credit: Unlock Your Dream Ride

- Cheap Auto Insurance: Unlock Savings Today!

- Auto Loan Refinance: Unlock Savings Today!

- Best Extended Warranty: Ultimate Protection Guide

- Auto Repair near Me: Find Top Rated Services Instantly